Stonewell Bookkeeping Can Be Fun For Everyone

Wiki Article

Not known Facts About Stonewell Bookkeeping

Table of ContentsThe 9-Minute Rule for Stonewell BookkeepingStonewell Bookkeeping Things To Know Before You Get ThisThe 25-Second Trick For Stonewell BookkeepingThe Stonewell Bookkeeping StatementsStonewell Bookkeeping Fundamentals Explained

Every company, from hand-made cloth manufacturers to video game developers to restaurant chains, gains and spends cash. Bookkeepers help you track all of it. Yet what do they actually do? It's difficult recognizing all the solution to this question if you've been entirely concentrated on expanding your organization. You could not completely recognize or also begin to totally appreciate what a bookkeeper does.The background of accounting go back to the beginning of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants maintained documents on clay tablet computers to maintain accounts of deals in remote cities. In colonial America, a Waste Schedule was typically made use of in bookkeeping. It was composed of an everyday journal of every purchase in the chronological order.

Local business may count exclusively on an accountant initially, however as they expand, having both professionals on board comes to be increasingly beneficial. There are two main types of bookkeeping: single-entry and double-entry accounting. records one side of a monetary purchase, such as adding $100 to your expense account when you make a $100 purchase with your charge card.

A Biased View of Stonewell Bookkeeping

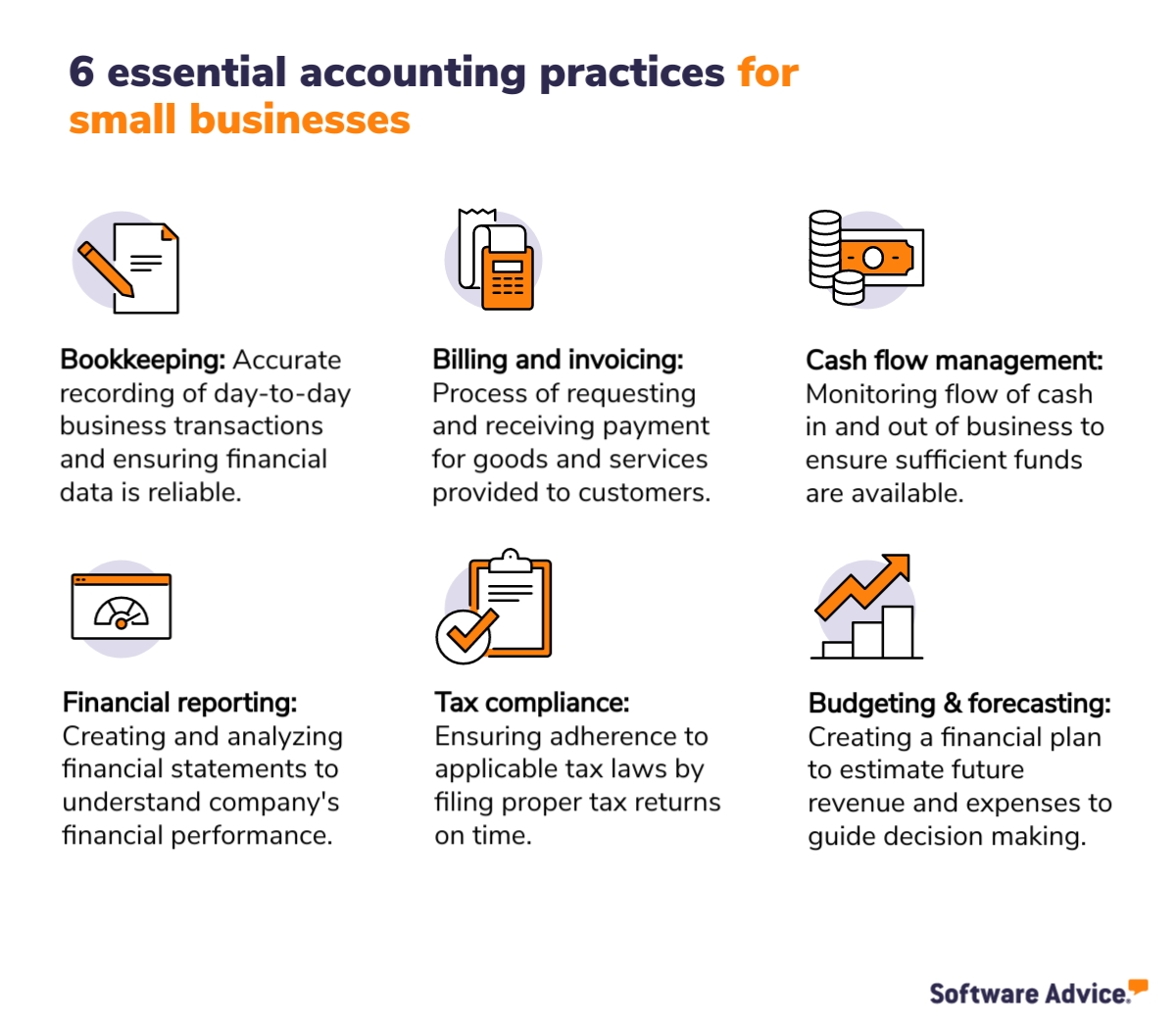

While low-cost, it's time consuming and prone to mistakes - https://www.pearltrees.com/hirestonewell#item769149560. These systems immediately sync with your credit scores card networks to provide you debt card transaction data in real-time, and immediately code all data around costs consisting of jobs, GL codes, places, and classifications.They guarantee that all documents complies with tax obligation policies and guidelines. They keep track of capital and regularly generate financial records that assist essential decision-makers in a company to push business ahead. Additionally, some bookkeepers likewise assist in maximizing payroll and invoice generation for a company. A successful bookkeeper requires the adhering to skills: Accuracy is type in monetary recordkeeping.

They typically begin with a macro viewpoint, such as an annual report or a profit and loss statement, and after that drill right into the details. Bookkeepers make sure that supplier and client records are always approximately date, even as individuals and organizations modification. They might likewise require to collaborate with other divisions to ensure that everybody is utilizing the same information.

The Ultimate Guide To Stonewell Bookkeeping

Getting in expenses into the accountancy system allows for accurate planning and decision-making. This aids companies receive payments much faster and improve cash money circulation.This assists avoid disparities. Bookkeepers regularly carry out physical inventory counts to prevent overemphasizing the value of possessions. This is a vital element that auditors meticulously check out. Entail internal auditors and contrast their matters with the recorded values. Accountants can function as freelancers or in-house employees, and their settlement varies depending upon the nature of their employment.

Freelancers frequently bill by the hour yet might supply flat-rate packages for details jobs., the typical accountant salary in the United States is. Bear in mind that wages can vary depending on experience, education, area, and industry.

Freelancers frequently bill by the hour yet might supply flat-rate packages for details jobs., the typical accountant salary in the United States is. Bear in mind that wages can vary depending on experience, education, area, and industry.The Buzz on Stonewell Bookkeeping

Several of the most usual documentation that organizations have to send to the federal government includesTransaction details Financial statementsTax compliance reportsCash circulation reportsIf your accounting is up to date all year, you can stay clear of a lots of tension during tax period. franchise opportunities. Persistence and interest to information are crucial to better bookkeeping

Seasonality is a component of any kind of task worldwide. For bookkeepers, seasonality means periods when repayments come flying in through the roofing, where having superior job can become a significant blocker. It becomes important to expect these moments beforehand and to finish any type of backlog before the stress duration hits.

Not known Facts About Stonewell Bookkeeping

Preventing this will minimize the danger of causing an IRS audit as it offers an accurate depiction of your finances. Some common to maintain your individual and organization funds different areUsing a business credit report card for all your company expensesHaving different monitoring accountsKeeping invoices for individual and overhead separate Imagine a world where your accounting is done for you.Employees can respond to this message with a photo of the receipt, and it will immediately match it for you! Sage Cost Administration supplies very customizable two-way integrations with copyright Online, copyright Desktop Computer, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These integrations are self-serve and require no coding. It can instantly import information such as employees, tasks, categories, GL codes, departments, job codes, cost codes, taxes, and much more, while exporting costs as bills, journal entries, or charge card costs in real-time.

Consider the adhering to pointers: An accountant that has actually dealt with businesses in your industry will much better recognize your specific requirements. Qualifications like those from AIPB or NACPB can be an indication of trustworthiness and competence. Request for references or inspect on the internet reviews to ensure you're working with someone reputable. is a wonderful place to begin.

Report this wiki page